International

- International markets, alongside the U.S., are poised to benefit from a global economic reawakening.

- A tough environment for travel and leisure is balanced by opportunities in health care, luxury goods and other sectors.

- Non-U.S. equity valuations that were attractive before the COVID-19 outbreak are even more so in this volatile market.

As a portfolio manager with the Capital Group Global Equity Fund™ (Canada), Carl Kawaja is often asked when international stocks will reassert themselves on the global stage. A decade of lagging returns compared to U.S. stocks has underscored that question. And even as most markets around the world bounce back from a pandemic-induced downturn, developed market stocks continue to trail.

Market leadership cycles can run for many years, even decades, Kawaja explains, but they often shift at key inflection points. While no one can accurately predict when that may happen, previous shifts have tended to occur abruptly and go sharply against the conventional wisdom of the time.

“I like to compare it to basketball — a sport where the U.S. historically has been fairly dominant,” he says. “But then Argentina started getting better, and Greece started getting better, and Spain started getting better. And, the next thing you know, the U.S. lost the Olympics.”

International opportunities

That’s not a prediction, Kawaja stresses, but an apt analogy to explain why investors shouldn’t ignore stocks outside of North America, which remain an important part of a diversified equity portfolio. There are incredibly successful and competitive companies based outside the U.S., he notes, and many of them are becoming more shareholder friendly. If and when market leadership changes, investors who shunned foreign stocks may be disappointed with that decision.

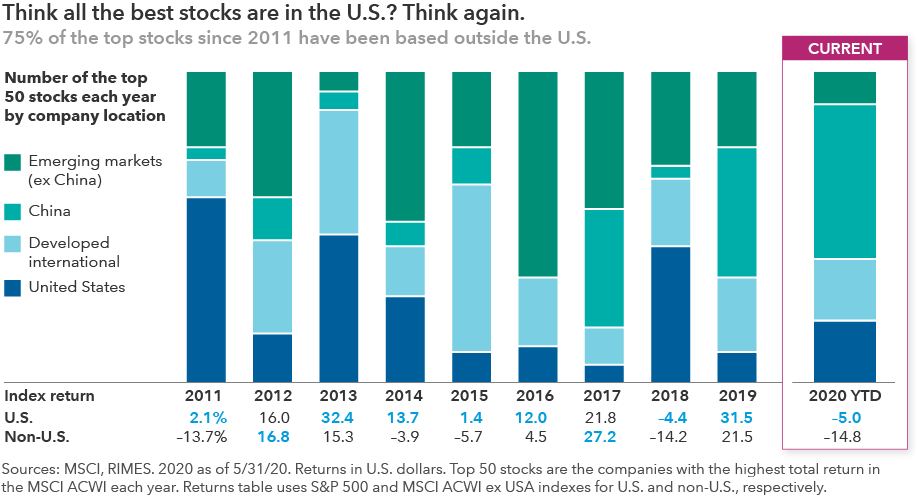

It’s a simple fact: Not all the best stocks are in the United States.

Indeed, one of the problems with evaluating stocks on an aggregate basis is that index returns don’t tell the whole story. Just because U.S. indices showed significantly greater returns than non-US indices over the past decade doesn’t mean the U.S. is the only place to find compelling investments.

In fact, looking at it on a company-by-company basis, it’s the opposite: The stocks with the best annual returns have been overwhelmingly located in non-U.S. markets.

That company-by-company trend is even more pronounced in the year-to-date period through May 31. The list of investable companies with the best year-to-date returns is dominated by Chinese firms. That’s not surprising, given China was the first country to get hit by the COVID-19 outbreak and among the first to emerge from lockdown.

While the YTD period is a very short time frame, the trend has generally played out over longer periods as well. Why? It’s all about opportunity set. There are roughly three times as many foreign stocks as domestic. So why fish in a smaller pond when there are great companies all over the world? It’s important to have the flexibility to choose among the best companies, no matter where they are located.

European economic outlook dims

While international markets have rallied off the lows of March, the economic picture isn’t nearly as rosy. Particularly in Europe, where travel and tourism are crucial segments of the economy, the chances of a speedy economic recovery this year are dwindling, says Robert Lind, an economist based in Capital Group’s London office.

“In Europe, we are still picking through the rubble of the shutdowns,” Lind explains. “It’s unlikely that we will see a return to normal activity in the travel and tourism industry any time soon, which is bad news for countries such as France, Italy and Spain.”

At the same time, there are some relative bright spots. Germany appears to be weathering the storm in better shape, perhaps because of its close trade ties to China. As China’s economy reopens, German manufacturers are firing up plants that produce luxury cars, electrical machinery and chemical goods. “As Europe’s single largest economy, Germany could help lead the way back,” Lind adds.

Central banks and national lawmakers have responded with massive new monetary and fiscal stimulus measures in an attempt to lessen the severity of an expected European recession this year. Given these aggressive measures to support the economy, “We could see a growth surprise in 2021,” Lind says.

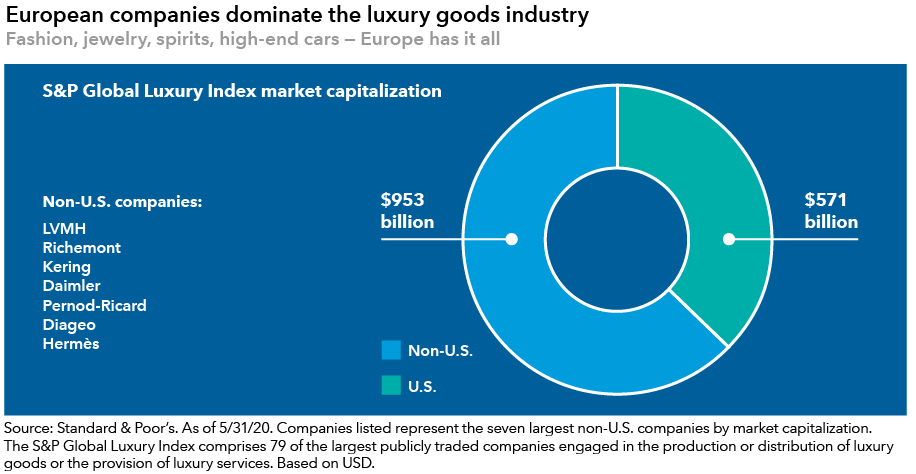

Pent-up demand for luxury goods has the potential to provide a substantial boost to companies in that sector, where European firms such as LVMH, Richemont and Kering dominate the market. China may now be providing a glimpse into this future. For instance, when Hermès reopened its Guangzhou store in April, first-day sales hit a record high of US$2.7 million, according to the fashion industry trade newspaper Women’s Wear Daily.

Compelling investment opportunities abound outside Europe as well. Last year, at a time when political pressure was weighing on many U.S. health care companies, Japanese pharmaceutical giant Daiichi Sankyo was one of the top-returning stocks.

Japan is also home to many cutting-edge robotics firms, including Murata and Fanuc. Some of the world’s most successful technology companies are based in Asia, including Samsung, Taiwan Semiconductor, Tencent and Alibaba. Meanwhile, Kweichow Moutai is far from a household name outside of China, but it became the world's largest spirits company by market value after its stock price soared in 2019.

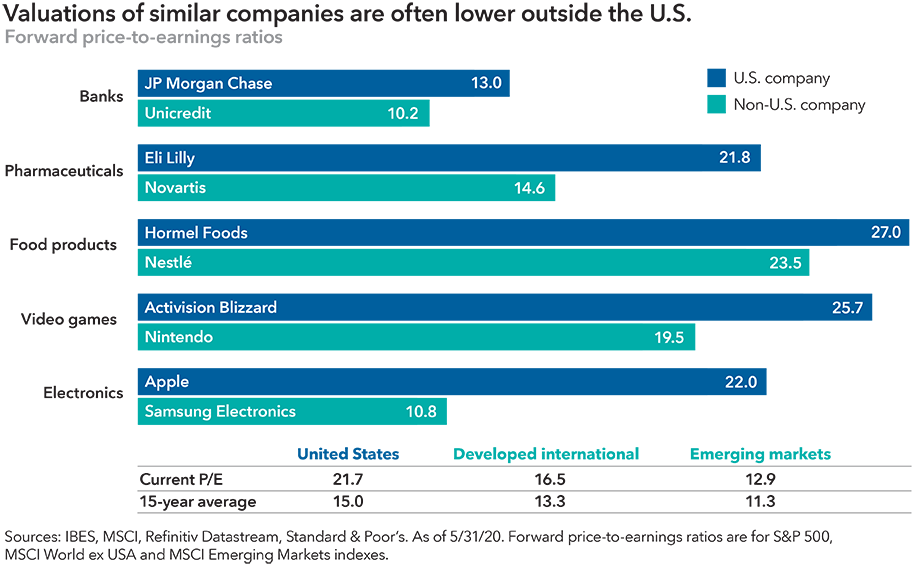

Valuations have also tended to be more attractive outside the U.S. In fact, that trend hasn’t changed much in the COVID-19 era; if anything, it has accelerated. Comparing similar companies in U.S. and non-U.S. markets often reveals a valuation gap — and sometimes a big one, such as the price-to-earnings ratio gap between Apple and Samsung Electronics (22 vs. 10.8). See the chart below for more examples and aggregate figures.

Emerging markets outlook: Keep an eye on disruption and innovation

In emerging markets countries, a good deal of uncertainty lies ahead for investors, ranging from the pace of China’s economic recovery, to the success of quarantine measures, to the stability of commodities prices. So far this year there have been dramatic monthly swings in the benchmark indices for many developing countries.

Underneath all the volatility, however, secular growth trends that existed long before the coronavirus outbreak continued to flourish despite trade war rhetoric and supply chain dislocations. Chief among them is the growth of digital platforms targeting large and growing consumer bases.

In recent years, there’s been a fundamental shift in emerging markets, largely led by innovative companies in China. Disruptive digital business models are creating intriguing investment opportunities, more so than old economy companies tied to commodities prices or manufacturing. In that respect, this year is no different.

Some of the best-returning stocks in the benchmark MSCI Emerging Markets Investable Market Index have been companies that operate internet platforms involved in consumer goods, video games and mobile cash transactions. Not surprisingly, Chinese companies head the list, particularly those focused on domestic consumption that are less affected by trade issues.

While Tencent or Alibaba are known quantities in America, there is a second wave of up-and-coming companies in certain fields. Examples include Meituan Diaping, China’s largest food and service delivery platform, and Wuxi Apptec, which provides R&D and manufacturing services to global health care companies.

“I’m excited about opportunities in the small- and mid-cap space where there are a number of entrepreneurial companies with large addressable markets in China,” says portfolio manager Chris Thomsen. Given China’s large population and an expanding middle class, these companies don’t necessarily need to expand abroad to grow sales and build market value.

“I find China to be one of the only countries where companies can rapidly scale up to become multi-billion-dollar companies within just a decade,” he adds. “As always, the challenge is to find the right ones.”

Our latest insights

-

-

Global Equities

-

Artificial Intelligence

-

Technology & Innovation

-

RELATED INSIGHTS

-

-

-

Artificial Intelligence

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian mutual funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Carl Kawaja

Carl Kawaja

Robert Lind

Robert Lind

Chris Thomsen

Chris Thomsen