Emerging Markets

As emerging markets matured over the last couple of decades, many countries began issuing bonds denominated in their respective local currencies rather than U.S. dollars. This has created a valuable sub-asset class worth more than $3 trillion alongside U.S. dollar-denominated emerging markets debt. Given projections for U.S. deficit growth and the potential for sustained U.S. dollar weakness, we believe now is a good time for institutional investors to consider their allocations to this large and growing segment of the emerging markets debt universe.

In our view, EM local currency bonds can offer an attractive risk-reward trade-off for investors seeking a high level of current income and U.S. dollar diversification. Countries that issue local currency debt tend to have independent central banks, developed yield curves and investment-grade credit ratings.

Here are four reasons to consider investing in EM local currency bonds in diversified portfolios.

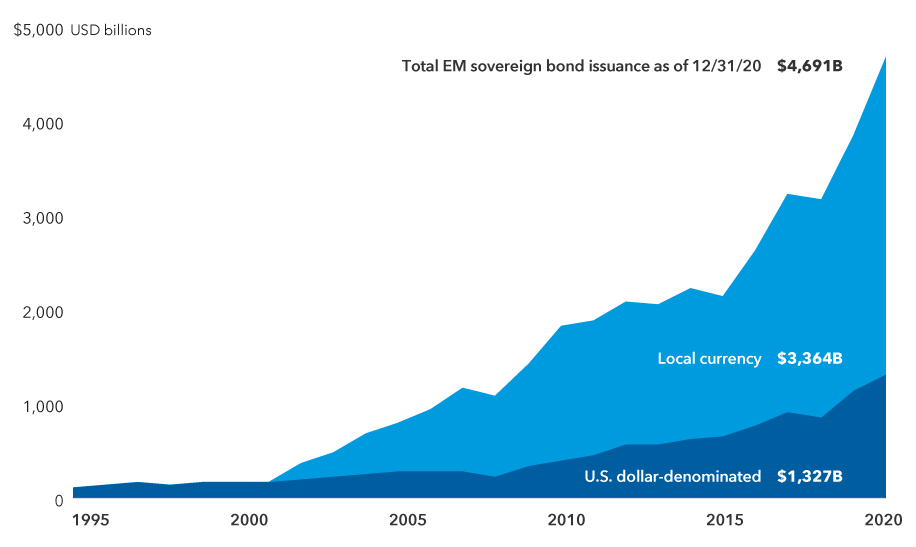

1. The universe for emerging markets debt has changed significantly over the last 20 years

Local currency bond issuance has increased significantly since the early 2000s and is now the predominant issuer base within the asset class. It also represents the greatest degree of depth within fixed income emerging markets and benefits from a broad investor base consisting of foreign investors, local governments, pension funds, banks and other domestic investors.

Issuance has soared as economies have matured

Source: J.P. Morgan. Emerging markets U.S. dollar-denominated sovereign bonds represented by J.P. Morgan EMBI Global Bond Index; emerging markets local currency sovereign bonds represented by J.P. Morgan GBI-EM Broad Index. Data as of December 31, 2020.

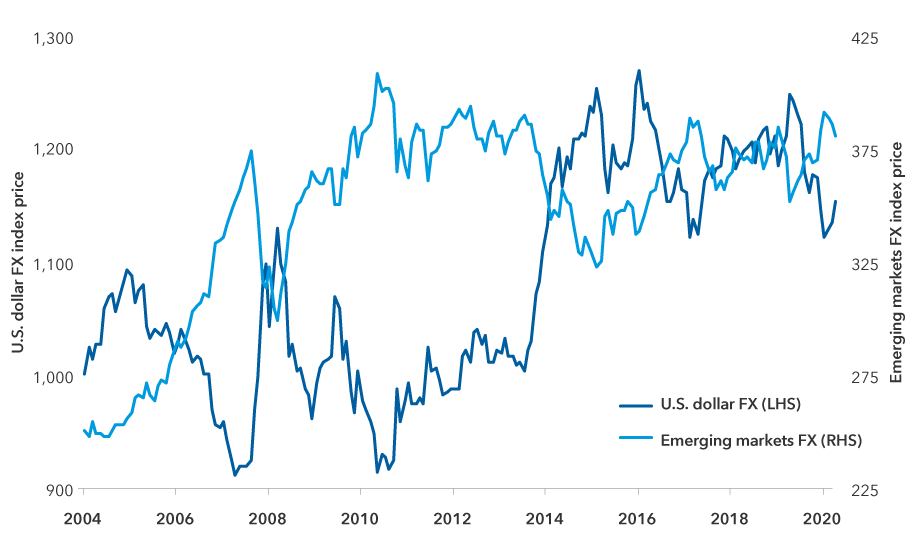

2. Local currency bonds provide U.S. dollar diversification

Emerging markets currencies allow investors to diversify their U.S. dollar exposure within a broader portfolio. Moreover, diversified allocations to these currencies can provide an opportunity to benefit from potentially stronger global economic growth, which has historically coincided with appreciation in their value relative to the U.S. dollar.

Emerging markets currencies can provide U.S. dollar diversification

Sources: Bloomberg, J.P. Morgan. U.S. dollar FX is represented by the Bloomberg Dollar Spot Index; emerging markets FX is represented by the J.P. Morgan Emerging Local Markets Index Plus. Data as of March 31, 2021.

3. Emerging markets local currency bonds can provide a high level of current income

Emerging markets local currency debt has at times provided a higher yield than its U.S. dollar-denominated counterpart. Both have provided a meaningful pickup in yield over U.S. core bonds. A recovery in global economic growth could be supportive of the asset class and may benefit emerging markets currencies in particular over the longer term.

Emerging markets local currency and U.S. dollar bonds have provided a meaningful pickup in yield over U.S. core bonds

Sources: J.P. Morgan, Bloomberg. U.S. dollar EM debt represented by J.P. Morgan EMBI Global Diversified Index; local EM debt represented by J.P. Morgan GBI-EM Global Diversified Bond Index; U.S. core bonds represented by Bloomberg Barclays U.S. Aggregate Index. Yield to maturity is the rate of return anticipated on a bond if it is held until the maturity date. Data as of March 31, 2021.

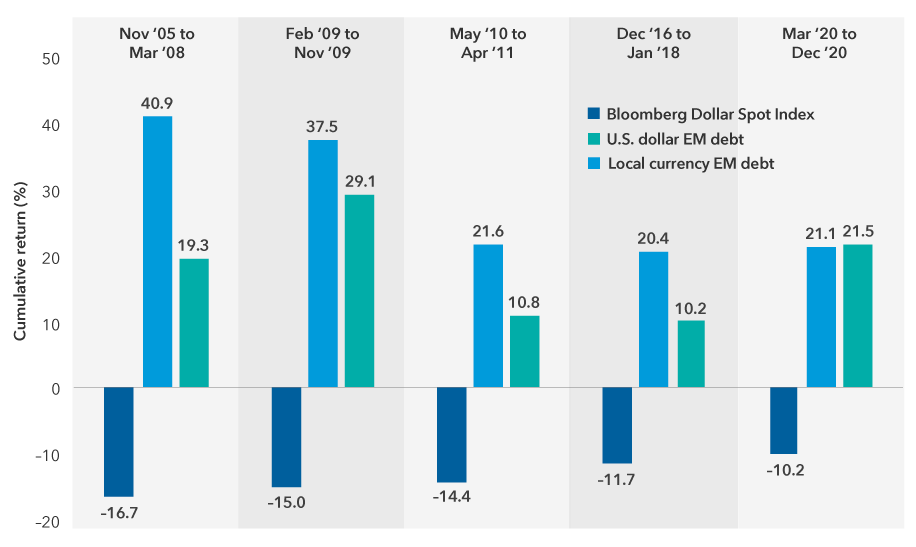

4. A weaker dollar typically benefits emerging markets local currency bonds

Given relatively low yields in the U.S. coupled with “twin” (fiscal and current account) deficits that are expected to grow, it is reasonable to believe the U.S. dollar is likely to move into a period of longer term decline. This could meaningfully benefit emerging markets bonds and currencies. Although both local currency and dollar-denominated emerging markets bonds have historically provided strong results when the U.S. dollar was weak or weakening, local currency debt has typically added significantly more value.

Local currency debt has added value in periods of U.S. dollar weakness

Sources: Bloomberg, J.P. Morgan. U.S. dollar-denominated emerging markets debt represented by the J.P. Morgan EMBI Global Diversified Index; local currency emerging markets debt represented by the J.P. Morgan GBI-EM Global Diversified Index. Reflects cumulative results during periods when the Bloomberg Dollar Spot Index declined by more than 10%. Data as of March 31, 2021.

The bottom line: Emerging markets local currency bonds have provided U.S. dollar diversification and a high level of current income, and have historically added significant value during most periods of U.S. dollar weakness. For these reasons, investors may want to consider this asset class when making asset allocation decisions within their broader portfolios.

Bloomberg® is a trademark of Bloomberg Finance L.P. (collectively with its affiliates, “Bloomberg”). Barclays® is a trademark of BarclaysBank Plc (collectively with its affiliates, “Barclays”), used under license. Neither Bloomberg nor Barclays approves or endorses this material, guarantees the accuracy or completeness of any information herein and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

Information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The Index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright 2021, J.P. Morgan Chase & Co. All rights reserved.

Market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

J.P. Morgan Emerging Markets Bond Index – Global tracks total returns for U.S. dollar-denominated debt instruments issued by emerging markets sovereign and quasi-sovereign entities, including Brady bonds, loans and eurobonds. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of account fees, expenses or U.S. federal income taxes.

J.P. Morgan Government Bond Index – Emerging Markets Global Diversified covers the universe of regularly traded, liquid fixed-rate, domestic currency emerging market government bonds to which international investors can gain exposure. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of account fees, expenses or U.S. federal income taxes.

The Bloomberg Dollar Spot Index tracks the performance of a basket of 10 leading global currencies versus the U.S. dollar. It has a dynamically updated composition and represents a diverse set of currencies that are important from trade and liquidity perspectives.

The J.P. Morgan Emerging Local Markets Index Plus Index tracks total returns for local currency-denominated money market instruments in emerging market countries. Local market FX performance is measured by capturing returns in the deliverable and non-deliverable FX markets for each member country.

The J.P. Morgan Emerging Market Bond Index (EMBI) Global Diversified is a uniquely weighted emerging market debt benchmark that tracks total returns for U.S. dollar-denominated bonds issued by emerging market sovereign and quasi-sovereign entities. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of account fees, expenses or U.S. federal income taxes.

J.P. Morgan Government Bond Index – Emerging Markets Global Diversified covers the universe of regularly traded, liquid fixed-rate, domestic currency emerging market government bonds to which international investors can gain exposure. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of account fees, expenses or U.S. federal income taxes.

Bloomberg Barclays Global Aggregate Index represents the global investment-grade fixed income markets. This index is unmanaged, and its results include reinvested distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.

Our latest insights

-

-

Interest Rates

-

Municipal Bonds

-

Artificial Intelligence

-

Target Date

RELATED INSIGHTS

-

-

Interest Rates

-

Municipal Bonds

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Harry Phinney

Harry Phinney

Joseph Dowd

Joseph Dowd