FACTORS DRIVING OUR SUCCESS

Discover what sets our Series apart

Target date funds have a lot in common. But the American Funds Target Date Series takes a distinctive approach that has delivered uncommon investment outcomes and helped thousands of participants come closer to achieving their financial dreams.

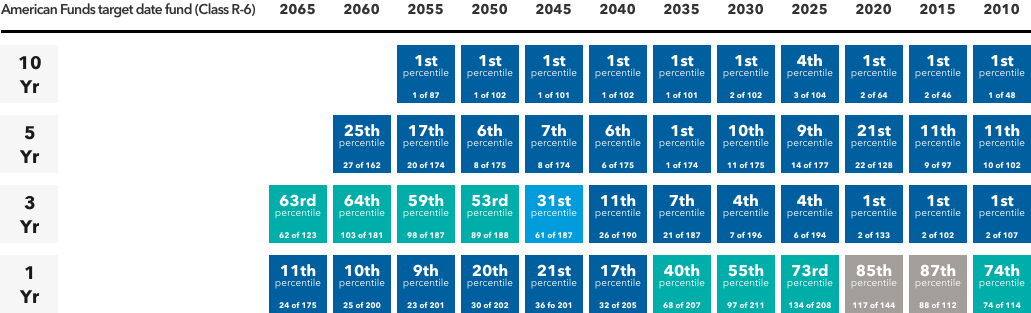

A history of strong results

Our Series has outpaced its peers over the long haul.

-

-

Return rankings

Retirement takes a lifetime to earn. Our Series focuses on building and preserving wealth over the long-term.

Morningstar category percentile return rankings

(with absolute rank and number of funds in category indicated)

Source: Capital Group, using Morningstar data as of December 31, 2023. Percentile rankings are calculated by Morningstar and reflect relative performance versus peers. A lower number is better: First percentile indicates a fund’s performance was in the top 1% of its peer group.

All funds began on February 1, 2007, except for 2055 (February 1, 2010), 2060 (March 27, 2015) and 2065 (March 27, 2020). Rankings are based on the funds’ average annual total returns (Class R-6 shares at net asset value) within the applicable Morningstar categories and don’t reflect the effects of sales charges, account fees or taxes. Past results are not predictive of results in future periods. Category averages include all share classes for the funds in the category. While American Funds R-6 shares don’t include fees for advisor compensation and service provider payments, the share classes represented in the Morningstar category have varying fee structures and can include these and other fees and charges, resulting in higher expenses and lower returns.

For a list of each fund’s Morningstar category, please see the “Morningstar categories” section. Categories include active, passive and hybrid target date funds, as well as those that are managed both “to” and “through” retirement. Approximately one-third of the funds within the 2000–2010 category have a target date of 2005. In an effort to manage the risk of investors outliving their savings while managing volatility, our approach to allocating between stocks and bonds puts more emphasis on stocks (particularly on dividend-paying stocks) than some other target date funds. Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect expense reimbursements, without which they would have been lower.

-

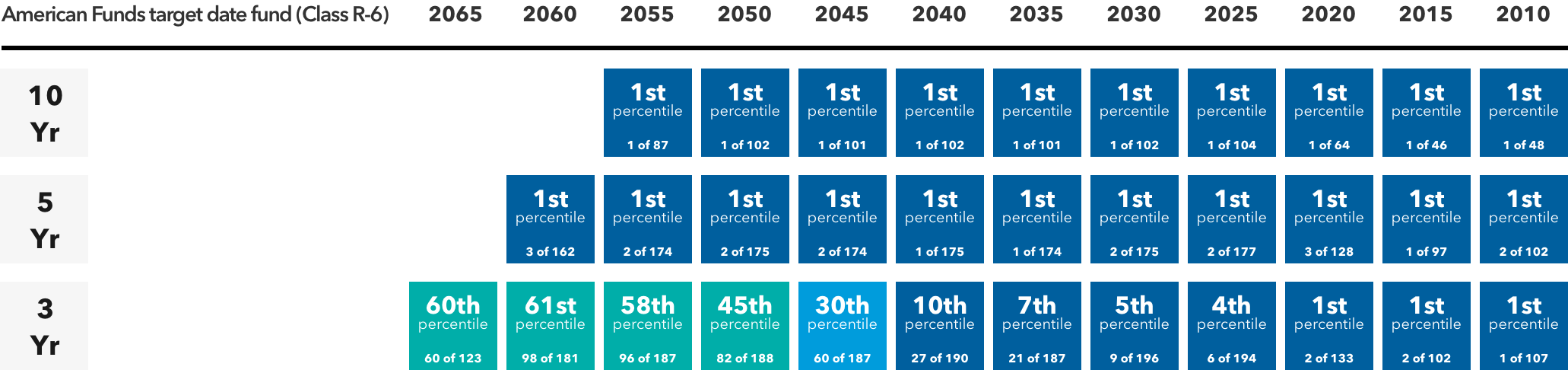

Sharpe ratio rankings**

On a risk-adjusted basis, our Series’ results have been particularly strong thanks to a history of dampening exposure to market swings.

Morningstar category percentile Sharpe ratio rankings

(with absolute rank and number of funds in category indicated)

**Sharpe ratio uses standard deviation (a measure of volatility) and returns to determine the reward per unit of risk. The higher the ratio, the better the portfolio’s historical risk-adjusted performance.

Source: Capital Group, using Morningstar data as of December 31, 2023. Percentile rankings are calculated by Morningstar and reflect relative performance versus peers. A lower number is better: First percentile indicates a fund’s performance was in the top 1% of its peer group.All funds began on February 1, 2007, except for 2055 (February 1, 2010), 2060 (March 27, 2015) and 2065 (March 27, 2020). Rankings are based on the funds’ average annual total returns (Class R-6 shares at net asset value) within the applicable Morningstar categories and don’t reflect the effects of sales charges, account fees or taxes. Past results are not predictive of results in future periods. Category averages include all share classes for the funds in the category. While American Funds R-6 shares don’t include fees for advisor compensation and service provider payments, the share classes represented in the Morningstar category have varying fee structures and can include these and other fees and charges, resulting in higher expenses and lower returns.

For a list of each fund’s Morningstar category, please see the “Morningstar categories” section. Categories include active, passive and hybrid target date funds, as well as those that are managed both “to” and “through” retirement. Approximately one-third of the funds within the 2000–2010 category have a target date of 2005. In an effort to manage the risk of investors outliving their savings while managing volatility, our approach to allocating between stocks and bonds puts more emphasis on stocks (particularly on dividend-paying stocks) than some other target date funds. Investment results assume all distributions are reinvested and reflect applicable fees and expenses. When applicable, results reflect expense reimbursements, without which they would have been lower.

-

Recognized for our results.

American Funds was the DC plan provider selected most often as “a company I trust” and “easy for advisors to do business with.”‡

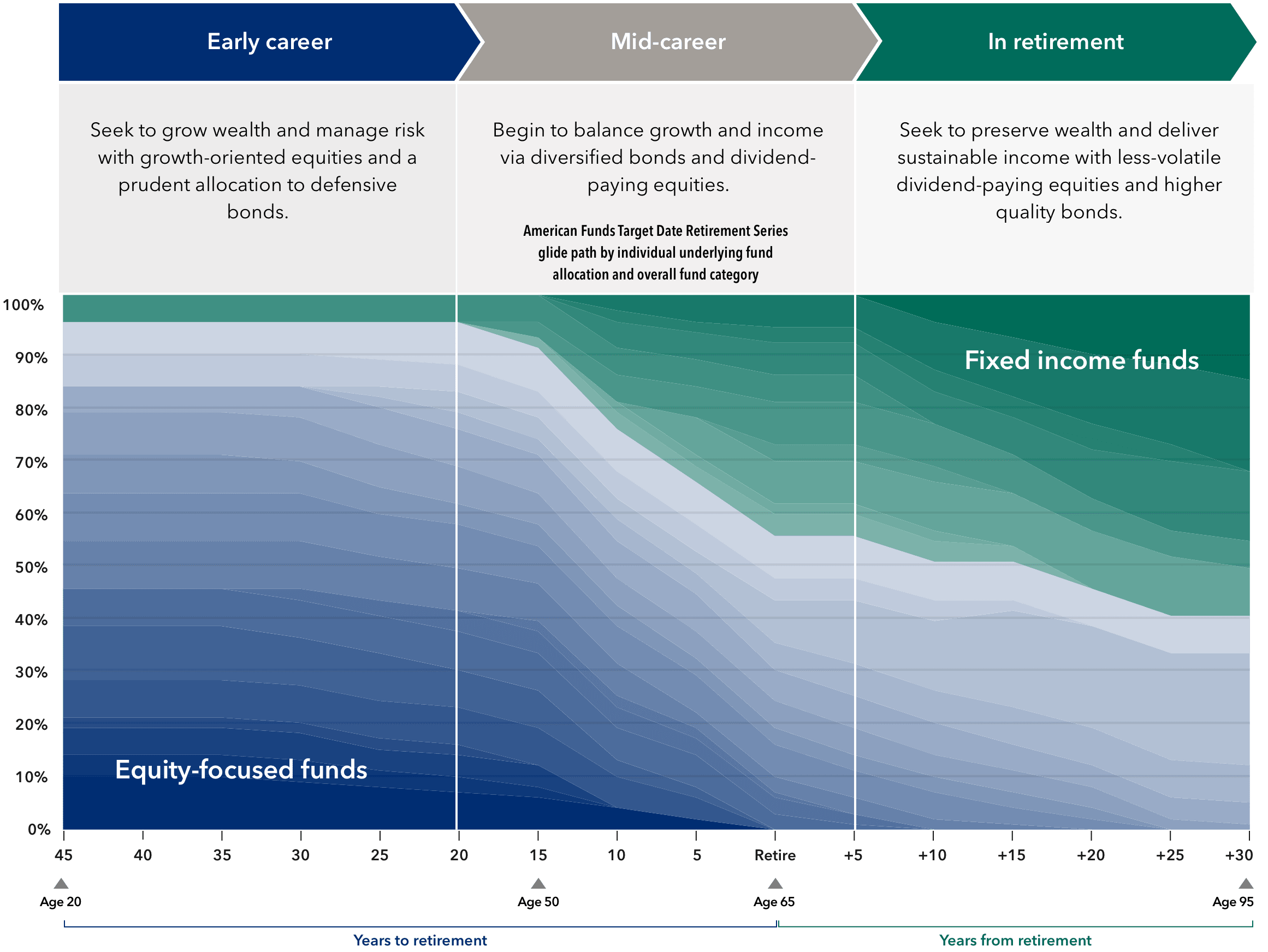

Seeking to build and preserve wealth

Our Series adapts to changing participant needs by adjusting both its stock/bond mix and the types of assets held through each stage of life.

Our Series adapts to changing participant needs by adjusting both its stock/bond mix and the types of assets held through each stage of life.

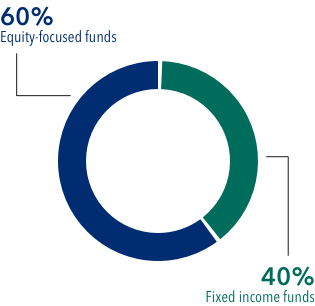

Early career

(roughly 45 to 20 years before retirement)

Seek to grow wealth and manage risk with predominantly growth-oriented equities and a prudent allocation to defensive bonds.

American Funds Target Date Retirement Series glide path approximation

Mid-career

(roughly 20 years before retirement to 5 years after retirement)

Begin to balance growth and income via diversified fixed income and dividend-paying equities.

American Funds Target Date Retirement Series glide path approximation

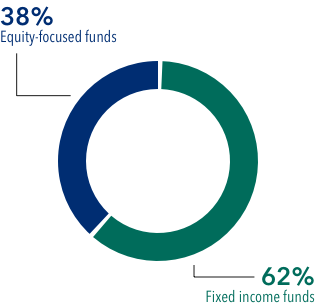

In retirement

(roughly 5 to 30 years after retirement)

Seek to preserve wealth and deliver sustainable income with less-volatile dividend-paying equities and higher quality bonds.

American Funds Target Date Retirement Series glide path approximation

The target allocations shown are as of December 31, 2023, and are subject to the oversight committee’s discretion. The investment adviser anticipates assets will be invested within a range that deviates no more than 10% above or below the allocations shown in the prospectus/characteristics statement. Underlying funds may be added or removed during the year. Visit capitalgroup.com for current allocations.

The target allocations shown are as of December 31, 2022, and are subject to the oversight committee’s discretion. The investment adviser anticipates assets will be invested within a range that deviates no more than 10% above or below the allocations shown in the prospectus/characteristics statement. Underlying funds may be added or removed during the year. Visit capitalgroup.com for current allocations.

Three factors driving our success

UNDERLYING FUNDS

Solid building blocks

Our funds have delivered peer-beating results and held up well in down markets.

LOW FEES

Delivering value at a low cost

We encourage a focus not just on expenses but on value delivered to participants.

GLIDE PATH

A distinctive approach

Our glide path is different. While our Series changes the mix between stocks and bonds, it also changes the types of assets held. This is designed to better align with participant needs over time.

Making a difference

Our Target Date Solutions Committee, which oversees the Series, brings a diversity of experience and draws on the fundamental research and quantitative resources of the global Capital Group team.

Link a bank account for withdrawals

Years of experience as of December 31, 2023.

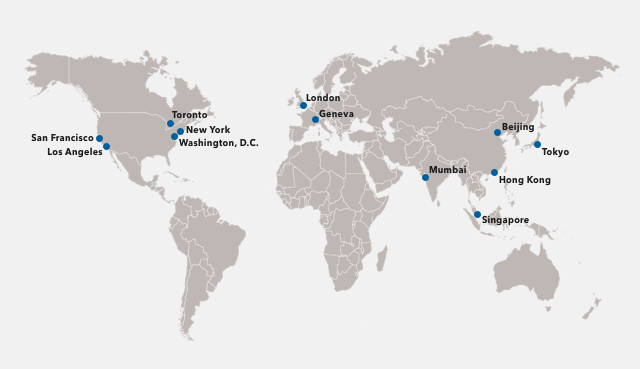

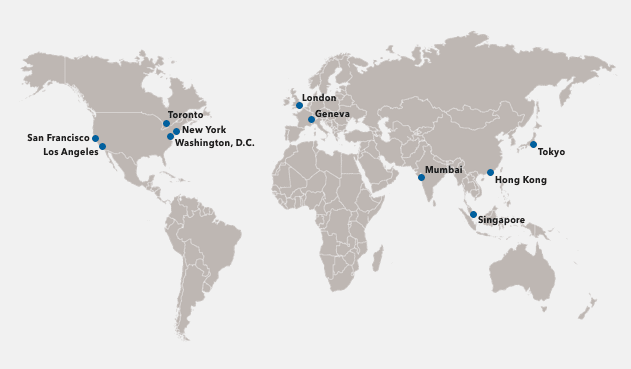

Global research offices

About Capital Group

Capital Group has a distinctive, long-term global investment approach that relies on fundamental research. Privately held since its founding in 1931 and with more than $2.5 trillion under management, the firm has more than 479 investment professionals worldwide.*

*As of December 31, 2023.

Global research offices

Global research offices:

Los Angeles |

Geneva |

San Francisco |

Mumbai |

New York |

Hong Kong |

Washington, D.C. |

Tokyo |

Toronto |

Singapore |

London |

|

Compare us to the competition

View our funds

Contact us

Our team is ready to help you help participants.

Important investment disclosures

Figures shown are past results and are not predictive of results in future periods. Current and future results may be lower or higher than those shown. Investing for short periods makes losses more likely. Prices and returns will vary, so investors may lose money. View mutual fund expense ratios and returns.

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Investors should carefully consider investment objectives, risks, charges and expenses. This and other important information is contained in the fund prospectuses and summary prospectuses, which can be obtained from a financial professional and should be read carefully before investing.

Investments in mortgage-related securities involve additional risks, such as prepayment risk.

The use of derivatives involves a variety of risks, which may be different from, or greater than, the risks associated with investing in traditional securities, such as stocks and bonds.

Fund shares of U.S. Government Securities Fund are not guaranteed by the U.S. government.

Allocations may not achieve investment objectives. The portfolios' risks are related to the risks of the underlying funds as described herein, in proportion to their allocations.

Lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than higher rated bonds.

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings.

While not directly correlated to changes in interest rates, the values of inflation-linked bonds generally fluctuate in response to changes in real interest rates and may experience greater losses than other debt securities with similar durations.

Although the target date portfolios are managed for investors on a projected retirement date time frame, the allocation strategy does not guarantee that investors' retirement goals will be met. Investment professionals manage the portfolio, moving it from a more growth-oriented strategy to a more income-oriented focus as the target date gets closer. The target date is the year that corresponds roughly to the year in which an investor is assumed to retire and begin taking withdrawals. Investment professionals continue to manage each portfolio for approximately 30 years after it reaches its target date.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility. These risks may be heightened in connection with investments in developing countries.

Small-company stocks entail additional risks, and they can fluctuate in price more than larger company stocks.

The Morningstar Medalist Rating™ is the summary expression of Morningstar's forward-looking analysis of investment strategies as offered via specific vehicles using a rating scale of Gold, Silver, Bronze, Neutral, and Negative. The Medalist Ratings indicate which investments Morningstar believes are likely to outperform a relevant index or peer group average on a risk-adjusted basis over time. Investment products are evaluated on three key pillars (People, Parent, and Process) which, when coupled with a fee assessment, forms the basis for Morningstar's conviction in those products' investment merits and determines the Medalist Rating they're assigned. Pillar ratings take the form of Low, Below Average, Average, Above Average, and High. Pillars may be evaluated via an analyst's qualitative assessment (either directly to a vehicle the analyst covers or indirectly when the pillar ratings of a covered vehicle are mapped to a related uncovered vehicle) or using algorithmic techniques. Vehicles are sorted by their expected performance into rating groups defined by their Morningstar Category and their active or passive status. When analysts directly cover a vehicle, they assign the three pillar ratings based on their qualitative assessment, subject to the oversight of the Analyst Rating Committee, and monitor and reevaluate them at least every 14 months. When the vehicles are covered either indirectly by analysts or by algorithm, the ratings are assigned monthly. For more detailed information about these ratings, including their methodology, please go to global.morningstar.com/managerdisclosures/. The Morningstar Medalist Ratings are not statements of fact, nor are they credit or risk ratings. The Morningstar Medalist Rating (i) should not be used as the sole basis in evaluating an investment product, (ii) involves unknown risks and uncertainties which may cause expectations not to occur or to differ significantly from what was expected, (iii) are not guaranteed to be based on complete or accurate assumptions or models when determined algorithmically, (iv) involve the risk that the return target will not be met due to such things as unforeseen changes in management, technology, economic development, interest rate development, operating and/or material costs, competitive pressure, supervisory law, exchange rate, tax rates, exchange rate changes, and/or changes in political and social conditions, and (v) should not be considered an offer or solicitation to buy or sell the investment product. A change in the fundamental factors underlying the Morningstar Medalist Rating can mean that the rating is subsequently no longer accurate.

Capital Group offers a range of share classes designed to meet the needs of retirement plan sponsors and participants. The different share classes incorporate varying levels of financial professional compensation and service provider payments. Because Class R-6 shares do not include any recordkeeping payments, expenses are lower and results are higher. Other share classes that include recordkeeping costs have higher expenses and lower results than Class R-6.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

All Capital Group trademarks mentioned are owned by The Capital Group Companies, Inc., an affiliated company or fund. All other company and product names mentioned are the property of their respective companies.

Investment results assume all distributions are reinvested and reflect applicable fees and expenses.

When applicable, results reflect fee waivers and/or expense reimbursements, without which they would have been lower and net expenses higher. Please refer to capitalgroup.com for more information. Read details about how waivers and/or reimbursements affect the results for each fund. View results and yields without fee waiver and/or expense reimbursement.

Certain share classes were offered after the inception dates of some funds. Results for these shares prior to the dates of first sale are hypothetical based on the original share class results without a sales charge, adjusted for typical estimated expenses.

- Class R-6 shares were first offered on 5/1/2009.

Use of this website is intended for U.S. residents only.

American Funds Distributors, Inc.

This content, developed by Capital Group, home of American Funds, should not be used as a primary basis for investment decisions and is not intended to serve as impartial investment or fiduciary advice.

© 2024 Morningstar, Inc. All Rights Reserved. Some of the information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar, its content providers nor Capital Group are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. Information is calculated by Morningstar. Due to differing calculation methods, the figures shown here may differ from those calculated by Capital Group.

*Source: Kephart, Jason. “American Funds Target Date Retirement Series®,” Morningstar Target-Date Fund Series Report, January 29, 2024.

†Source: Refinitiv Lipper Fund Awards. © 2023 Refinitiv. All rights reserved. Used under license. As of March 24, 2023, 10 vintages in American Funds Target Date Retirement Series received awards in at least one of the three-, five- or 10-year periods for Class R-6 shares. For Class F-3, the 2030 vintage was recognized in the three- and five-year periods and the 2035 vintage was recognized in the five-year period. The Refinitiv Lipper Fund Awards, granted annually, highlight funds and fund companies that have excelled in delivering consistently strong risk-adjusted performance relative to their peers. The Refinitiv Lipper Fund Awards are based on the Lipper Leader for Consistent Return rating, which is a risk-adjusted performance measure calculated over 36, 60 and 120 months. The fund with the highest Lipper Leader for Consistent Return (Effective Return) value in each eligible classification wins the Refinitiv Lipper Fund Award. For more information, see lipperfundawards.com. Although Refinitiv Lipper makes reasonable efforts to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by Refinitiv Lipper.

‡Source: Escalent, Cogent Syndicated. Retirement Plan Advisor Trends, October 2023. Methodology: 503 respondents participated in a web survey conducted September 8–14, 2023. The respondents consisted of financial advisors managing defined contribution plans. In Ownership of Core Brand Attributes — Tier 1, across the most vital attributes, American Funds was selected most often in response to the question “Which — if any — of these DC plan providers are described by this statement: ‘Is a company I trust?’ and ‘Easy for advisors to do business with’?”

Morningstar categories

American Funds Target Date 2010 |

Morningstar Target Date 2000–2010 |

American Funds Target Date 2015 |

Morningstar Target Date 2015 |

American Funds Target Date 2020 |

Morningstar Target Date 2020 |

American Funds Target Date 2025 |

Morningstar Target Date 2025 |

American Funds Target Date 2030 |

Morningstar Target Date 2030 |

American Funds Target Date 2035 |

Morningstar Target Date 2035 |

American Funds Target Date 2040 |

Morningstar Target Date 2040 |

American Funds Target Date 2045 |

Morningstar Target Date 2045 |

American Funds Target Date 2050 |

Morningstar Target Date 2050 |

American Funds Target Date 2055 |

Morningstar Target Date 2055 |

American Funds Target Date 2060 |

Morningstar Target Date 2060 |

American Funds Target Date 2065 |

Morningstar Target Date 2065+ |

Index definitions

The S&P Target Date Series comprises 12 multi-asset class indexes, each corresponding to a particular target retirement date. Each index provides varying levels of exposure to equities and fixed income. Each target date allocation is created and retired according to a predetermined schedule related to the respective target date.

For quarterly updates of fund allocations, click here.