Aerospace

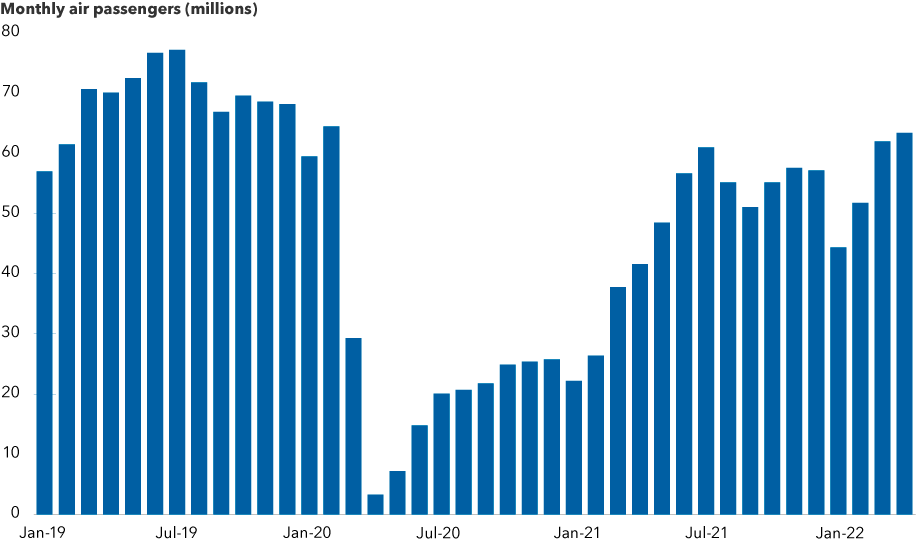

After two years of relatively empty skies, Ryanair CEO Michael O'Leary is an eyewitness to the incredible resurgence of demand for air travel. Faced with long security delays at Dublin Airport, he implored the Irish government to call up the army last month to help process eager travelers flooding the terminals.

As the global economy gradually emerges from the pandemic, airports around the world are dealing with a crush of passengers looking to make up for lost time. Fueled by pent-up demand, many are flying for the first time since the COVID-19 virus crippled the travel industry. For the airlines, the turnaround in demand has been fast and furious, surpassing even the most optimistic expectations.

“Demand is turning back on almost as quickly as it turned off,” says Capital Group equity analyst Todd Saligman, who covers the aerospace industry in the U.S. and Europe. “Many U.S. airlines have reported that March was the strongest booking month in history, and we are seeing similar strength in Europe.”

U.S. air travel is rebounding from a sharp pandemic-era downturn

Sources: Capital Group, U.S. Transportation Security Administration. Data reflects number of travelers going through TSA airport checkpoints. As of 4/30/22.

Heading into the summer vacation season, air travel is likely to exceed pre-COVID levels in much of the Western world. That’s despite several headwinds facing the airlines today, including sharply higher fuel costs, a pilot shortage and fewer available flights as the industry ramps up to full strength. A resurgence of the virus is holding back China’s reopening, leaving Asian air travel lagging the U.S. and Europe at the moment.

“We’re not back to pre-COVID levels yet, but it’s just a matter of time,” Saligman notes. “Travel is a secular growth industry in a lot of countries. Only about 20% of the world’s population has ever been on an airplane. So there is huge room for growth, especially in emerging markets such as China and India, where the middle class is growing and air travel is still in its infancy.”

Volatility is in the air

Make no mistake, airline stocks are volatile. As a group, U.S. airline stocks fell 31% in 2020 as government-imposed lockdowns and bans on international travel brought air traffic to a virtual standstill. They fell another 2% in 2021, even as a reawakening economy lifted other sectors. It’s been a mixed bag so far this year, with the sector up nearly 10%, despite a pullback after Russia’s February 24 invasion of Ukraine.

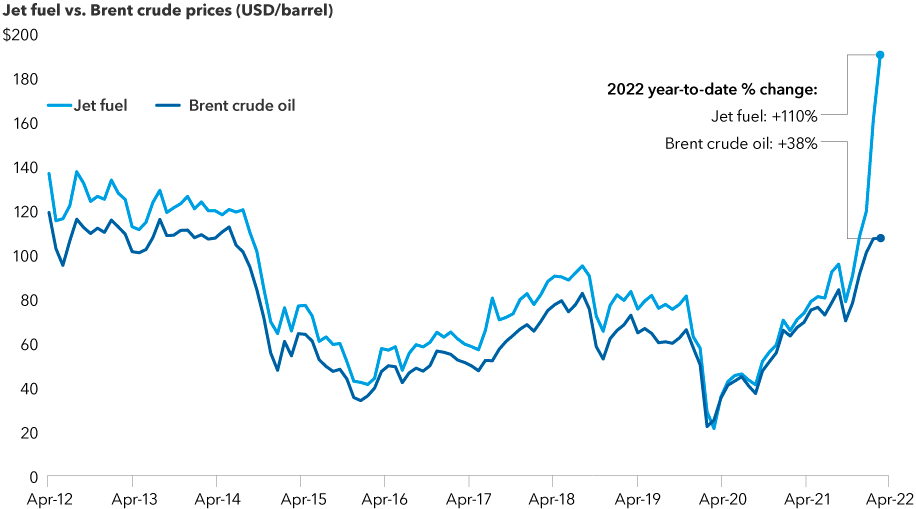

The war has contributed to a meteoric rise in the price of jet fuel, which has increased 110% this year, surpassing the rise in oil prices by a wide margin. Fuel is generally the second largest expense for airlines, after labour.

Jet fuel costs are rising even faster than oil prices

Sources: Capital Group, Refinitiv Datastream. Jet fuel prices in USD represented by the U.S. Gulf Coast Kerosene-Type Jet Spot Price; brent crude prices represented by the Europe Brent Spot Price. As of 4/30/2022.

In normal times, such a dramatic increase in jet fuel prices would hurt the highly competitive aviation industry. But these aren’t normal times. “Airlines have largely been able to pass these costs along in the form of higher airfares,” Saligman explains. “These stocks will likely continue to be volatile, but I think the next six to 12 months could be a very strong period for the airlines, as well as cruise lines and other travel-related companies.”

Indeed, two of the largest U.S. carriers — American Airlines and Delta Airlines — are both forecasting record-high revenues in the current quarter ending June 30. In recent earnings calls, airline executives said they expect sales to soar during the summer travel season. “Demand is stronger than I’ve ever seen in my career,” said United CEO Scott Kirby, “and that’s even before business travel fully recovers.”

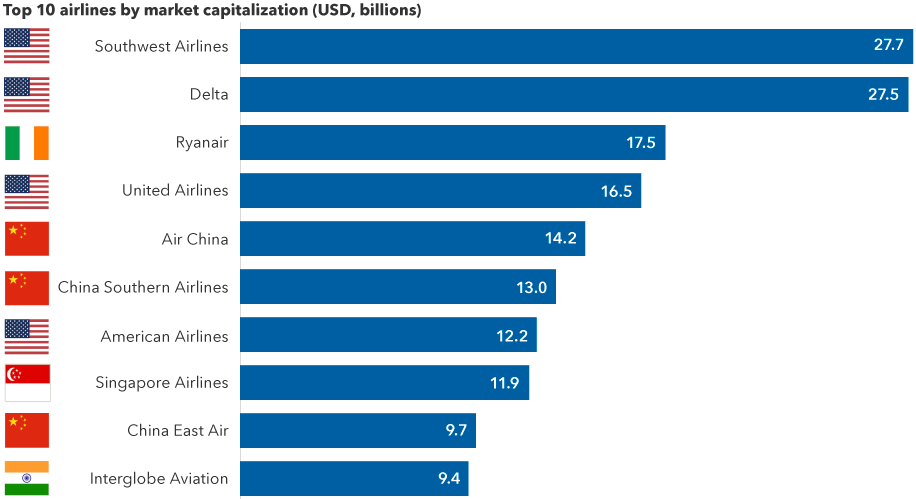

Airline industry poised for rapid growth in a post-pandemic world

Sources: Capital Group, MSCI, Refinitiv Datastream, RIMES. As of 4/30/22.

Come fly with me

Optimism for the airline industry comes with a few caveats. The recovery should proceed if energy prices don’t continue to skyrocket, the Russia-Ukraine conflict doesn’t spread and severe COVID restrictions aren’t once again imposed. Those are some big assumptions that may or may not play out according to plan. But over the long term, the outlook is favourable, says portfolio manager Steve Watson.

“I think COVID will go away, and people will want to fly again — it’s that simple,” says Watson, a portfolio manager on Capital Group Capital Income BuilderTM (Canada) and Capital Group Monthly Income PortfolioTM (Canada). “Investors should focus less on the timing and more on what cash flows and earnings will look like in the months and years ahead.”

What about the fear that Zoom or Webex video calls will replace the need for in-person business meetings? That’s nonsense, Watson says.

“Years ago, conference calls were supposed to kill business travel and that never really happened either,” he notes. “People who generate revenue face-to-face will be traveling.”

Long runway for “reopening” theme

As one of the few industries that has not fully participated in the COVID recovery period, many airlines are attractive from a valuation perspective, says portfolio manager Chris Thomsen.

Airlines have experienced a delayed recovery, largely due to the emergence of the COVID-19 omicron variant last December. With omicron fading in many parts of the world, airlines and other travel-related companies are well positioned to participate in the comeback that has lifted other sectors hard hit by the 2020 downturn.

Thomsen saw evidence of that on a recent trip from London to Los Angeles.

“The airports were crowded, restaurants were bustling and flights were full,” he says. “I think we are in a post-COVID world now. People want to get out and do all the things they couldn’t over the past two years. That’s going to benefit the travel industry for the next few years at least.”

Our latest insights

-

-

Interest Rates

-

Global Equities

-

Artificial Intelligence

-

Technology & Innovation

RELATED INSIGHTS

-

-

Artificial Intelligence

-

Technology & Innovation

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian mutual funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Todd Saligman

Todd Saligman

Steve Watson

Steve Watson

Chris Thomsen

Chris Thomsen