Energy

After three straight years of stellar performance, European renewable energy stocks have fallen back to earth in 2021. But the future is still bright for green power as the world’s transition to a low-carbon economy gathers steam.

In the short term, investor concerns about rising bond yields and inflation have dragged down the utilities sector. And a flood of cash into environmentally friendly investments in recent years has spurred fears of a green bubble. However, in my view, the fundamentals of Europe’s largest clean energy companies remain strong.

Clean energy is benefiting from three important secular tailwinds: falling renewable costs, new energy policies and economic stimulus. I call these factors the “Green Trifecta.” Moreover, the dominant companies, most of them based in Europe, have many advantages: a long runway of growth opportunities, strong development pipelines and development teams, significant scale benefits, robust balance sheets to fund investments and the benefit of vertical integration that many new entrants typically struggle to match. Although many investors continue to view these companies as bond proxies, there is potential for secular growth for many years.

Falling renewable costs

The biggest reason I expect clean energy companies to do well is that renewable technology just keeps getting cheaper.

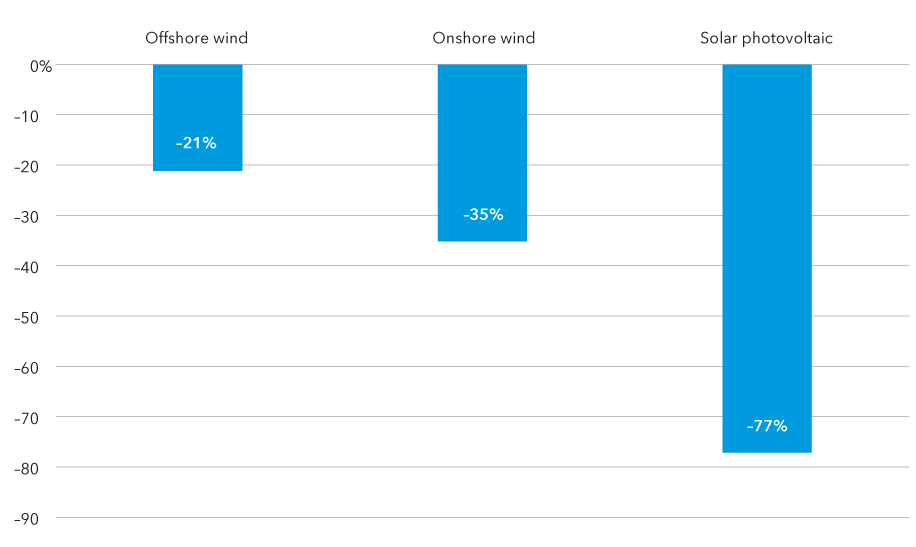

Renewables are already economically competitive as it is. And the cost of building a megawatt of clean power generation — whether that's onshore wind, offshore wind or solar photovoltaic — is falling and should continue to do so.

Every year, the average cost of production probably falls by between 10% and 15%. The same is true for the costs of battery storage or green hydrogen. I have yet to see any meaningful slowdown in the rate of cost reduction.

Change in lifetime cost of energy from 2010 to 2018

Sources: UN Environment Program; International Renewable Energy Agency.

As new technology is developed and renewable companies scale up, costs should fall even further. Take offshore wind, for example. Machines are getting bigger. Technologies to install and to build turbines are changing rapidly and the supply chain is evolving.

Denmark’s Orsted has established itself as a leader in this market by developing its own engineering, operation and maintenance skills. And there is scope to further industrialize the manufacturing process materially. Costs should continue to decline at pace.

So-called “learning effects” are playing a substantial role here. This is still an immature industry, and companies are consistently learning how to operate more efficiently.

Green hydrogen will be an important area to watch. It is seen by many experts as the key to decarbonizing industries like steel and shipping. Hydrogen gas is still expensive to produce without using fossil fuels, but this appears to be the next big energy transition technology.

If I map the improvements that are coming on the cost of the technology used to create green hydrogen, plus where the cost of clean energy is headed, I can see a really significant reduction in costs. They could fall by as much as three-quarters over the next five to 10 years, which is very similar to what happened in solar and onshore wind over the last decade or so.

There is a risk that Big Oil could muscle into the clean energy sector and threaten the dominance of today’s renewable majors, which include EDP, Enel, Engie, Iberdrola and Orsted. However, I believe the market is growing fast enough that there will be room for all. And while oil companies like BP and Shell have started to dip their toes into renewables as part of their net-zero plans, it will be hard to match the existing skills, scale and pipelines of the renewable majors.

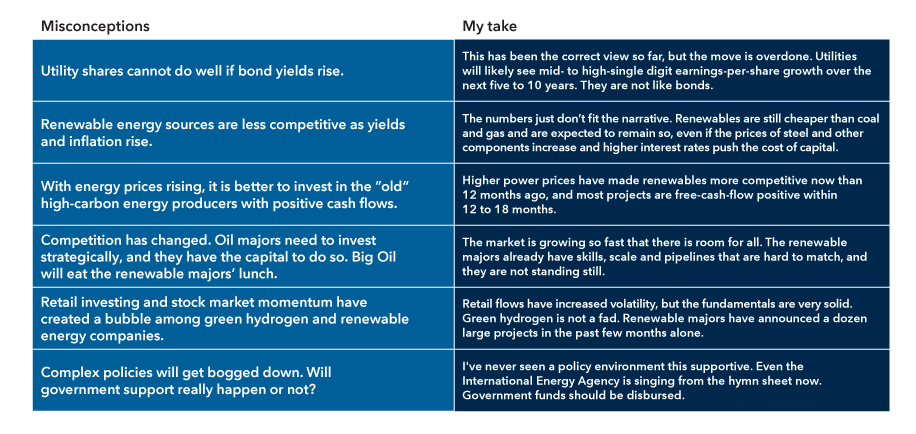

Investing in green energy has been fraught with misperceptions based on traditional views of the energy and utilities sectors. Below is my take on the most common of these views and how to consider green stocks through a more appropriate lens.

New energy policies

The second part of the Green Trifecta is the host of new policies being crafted by countries trying to curb their greenhouse gas emissions. Up to this point, little progress has been made on decarbonizing the global economy since the UN’s Paris Agreement went into effect in 2015. However, in recent months it has started looking like the world is kicking into gear.

The U.S. and China, which have long been climate laggards, have made major commitments to cut emissions and embrace clean energy. Of course, it remains to be seen how they back up those commitments, but the direction of travel is clear.

In August 2021, the Intergovernmental Panel on Climate Change released a landmark paper warning that global warming will reach 1.5 degrees Celsius by 2040, even in a best case scenario where the world acts swiftly to cut greenhouse gas emissions. UN Secretary-General António Guterres called this report a “code red for humanity.” The findings raise the stakes for November’s UN climate summit in Glasgow, known as COP26, where governments are expected to announce more ambitious plans to boost clean energy.

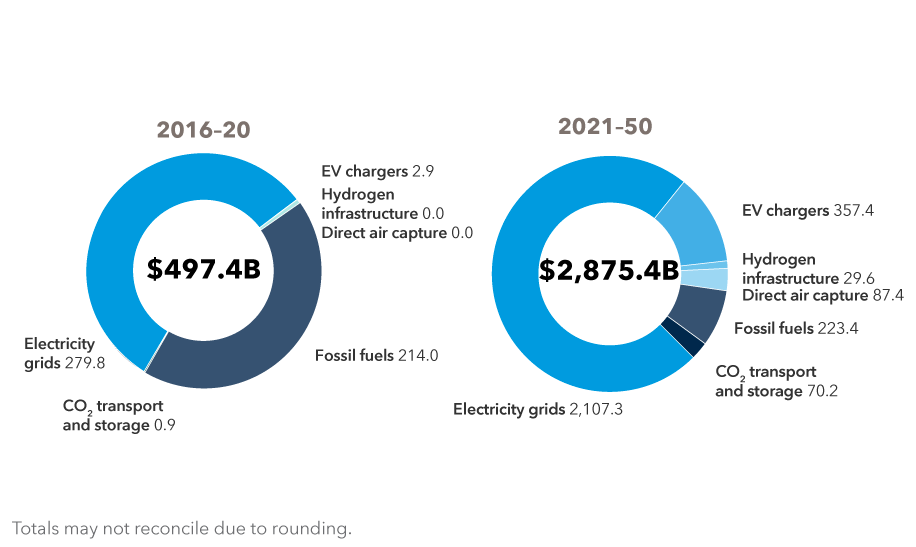

Even the International Energy Agency (IEA), an organization that has historically significantly underestimated renewables growth, now appears to realize the scale of what is required to avert a climate disaster. The IEA put out a report earlier this year that flags the need for investment in renewables to increase by three times by 2030.

Trillions in global investments expected for clean energy

Energy investment (USD billions)

Source: International Energy Agency, Net Zero by 2050 (May 2021).

The European Union, which is already a global leader in clean energy with roughly 20% renewables penetration, is primed for big growth. The EU plans to source half of its energy from renewables by 2030, and its long-awaited “Green Deal” framework is expected to push that even further, as the bloc seeks to cut greenhouse gas emissions to net zero by 2050.

The EU Green Deal will require a huge amount of investment ― as much as €7 trillion by 2050 ― which will come from a mix of private investment, public grants and subsidized lending.

Almost half of the investment is expected to go to renewables, electricity grids, battery storage and similar businesses, all of which are areas in which utilities are expected to invest heavily. For utility companies, this means growth. And that makes the sector more attractive than has historically been the case.

Green infrastructure investment set for big growth

Infrastructure investment (USD billions)

Source: International Energy Agency, Net Zero by 2050 (May 2021).

Post-pandemic economic stimulus

Governments around the world are also boosting clean energy as part of their plans to stimulate economies after the pandemic. In many countries, especially in Europe, much of the funding being made available for pandemic relief has strings attached that require it to be used in ways that will cut carbon.

The European Commission intends to provide expanded financing from the European Investment Bank (EIB) to increase support for renewables projects that are close to financial completion. The EIB has also pledged to stop providing money to fund fossil fuel projects, including natural gas.

I expect that European utilities that already have a large renewables footprint will continue to expand. Companies like Enel, Endesa, Iberdrola, EDP, Orsted and Engie have the biggest clean energy development teams, the ability to upsize their projects in construction and the deepest pipelines of new development projects.

There is global potential beyond Europe, as well.

The IEA estimates that clean energy investments (in renewables, networks and other areas) could reach $5 trillion per year by 2030, vs. $2 trillion currently. The IEA and International Monetary Fund jointly calculate that this investment could add nearly 0.5 percentage points per year to annual global gross domestic product growth. The IEA also noted that this could create around 10 million net new jobs per decade ― plus additional jobs in construction.

The Asian Infrastructure Investment Bank (AIIB) has identified green infrastructure as a top theme for Asia’s post-pandemic recovery.

In the U.S., President Joe Biden has embraced an energy plan that is ambitious and detailed. It falls far short of the so-called Green New Deal plan proposed by the Democratic Party’s progressive wing, but represents a sea change from the policies enacted by former President Donald Trump. In August, Biden signed an executive order aimed at boosting electric vehicle sales. He has also promised to back legislation that could spur significant government investment as he tries to fulfill his commitment to transition the U.S. to net-zero emissions by 2050.

Conclusion

At the end of the day, even without government funding, I see very little that could derail the clean energy revolution. The sweet spot in renewables is centred around economics, driven by cost reductions that are set to continue. This industry doesn’t need subsidies, even at low energy prices.

The momentum to decarbonize the world economy is powerful and enduring enough to change the historic playbook. That means it is time to stop thinking of utilities as staid, stodgy value investments that do not produce double-digit growth. These companies are not zero-growth bond proxies any longer, and in my view are poised to deliver strong investment results.

Our latest insights

-

-

Interest Rates

-

Global Equities

-

Artificial Intelligence

-

Technology & Innovation

RELATED INSIGHTS

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian mutual funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Bobby Chada

Bobby Chada