Dividends

- Dividend-paying stocks face pressure on many fronts today.

- Fundamental research and diversification are the keys to investing in income-oriented companies.

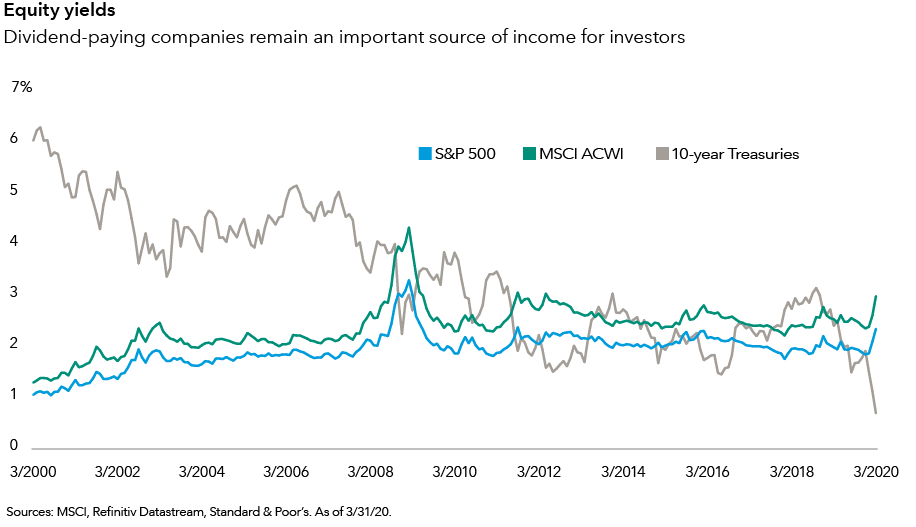

- Given ultralow interest rates, dividend payouts remain a crucial source of investment income.

With much of the world in quarantine, dividends are at a crossroads.

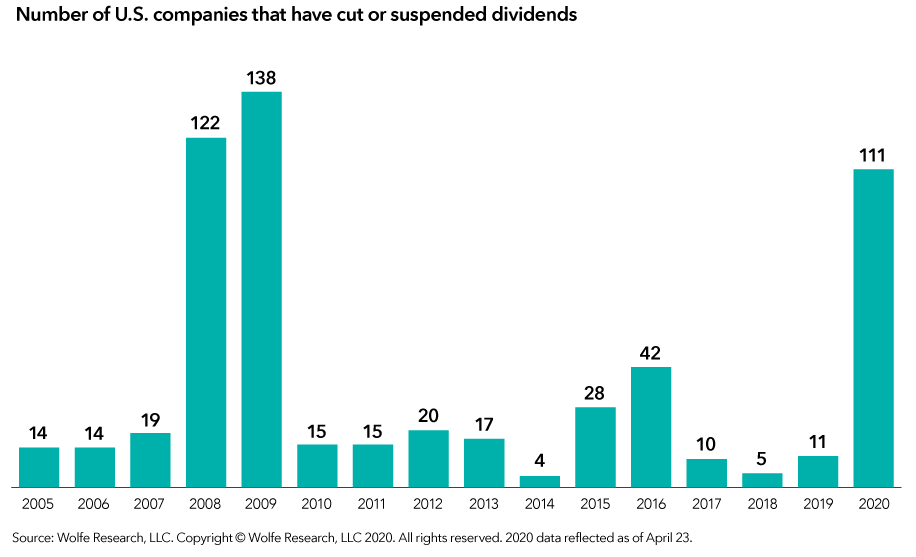

As the global economy remains essentially shut down, many companies face tough choices when it comes to returning cash to shareholders. In Canada, some steady dividend payers -- such as energy companies -- have announced dividend cuts and the concern is that others may follow suit. Dividend cuts and suspensions have jumped to the highest level in more than a decade. But even in this environment, some companies have maintained payouts and even raised them.

More than ever, this divergence in dividend commitment emphasizes the need for stock-specific research to help identify companies that can weather the storm. Interest rates also remain ultralow in developed markets, further underscoring the need to find companies that can generate sustainable income for investors who may be struggling to find it in bonds.

Dividends face challenges

In periods of economic duress, dividend cuts and suspensions are not unexpected. In the United States they have reached a level last seen during the Great Recession as sales have slowed and companies scramble to preserve cash. In Europe, dividends have come under immense political pressure as government regulators warn banks to preserve capital amid the coronavirus pandemic.

Many investors may be surprised to learn the degree to which ethical and social considerations are influencing dividend policy in a wide range of industries. This is especially prevalent among companies in France, Spain and Germany.

Many European companies have delayed annual meetings to reevaluate conditions later this year. Given that some companies in Europe pay dividends only once or twice a year, instead of quarterly, the monetary impact and uncertainty is significant.

Amid plummeting oil prices, Royal Dutch Shell on April 30 reduced its dividend for the first time since 1945, cutting it by more than 60% to 16 cents a share.

Rays of hope

Despite a severe global economic downturn, not all companies are following the same path. Many remain committed to sustaining and even increasing their dividends.

For example, in Europe, Nestlé and Zurich Insurance accelerated plans to hold virtual annual meetings and committed to paying dividends as planned. German chemical giant BASF is sticking to its payout, and several utilities in the U.K. have expressed strong support for sustaining their dividends during this turbulent time.

Among U.S. companies, Procter & Gamble and Johnson & Johnson have raised their disbursements, and Starbucks is maintaining its dividend. Even in the hard-hit oil sector, ExxonMobil said on April 29 it would maintain its quarterly dividend despite reporting a US$610 million first-quarter loss.

Assessing dividend sustainability

As companies take different paths, our investment analysts are rigorously scrutinizing balance sheet strength, financial conditions and cash-flow outlooks on a company-by-company basis.

Take the U.S. communications services industry. The business has consolidated in recent years, making several companies both providers and distributers of content. This consolidation has had financial ramifications.

AT&T acquired DirecTV and, more recently, Time Warner. As a result, AT&T’s net debt rose to US$150 billion and its earnings became more economically sensitive due to the cyclical nature of the advertising business. On the other hand, Verizon Communications has roughly US$130 billion of net debt and less exposure to advertising. Verizon stock has yielded less than AT&T, but its dividend is perceived to be safer by the market.

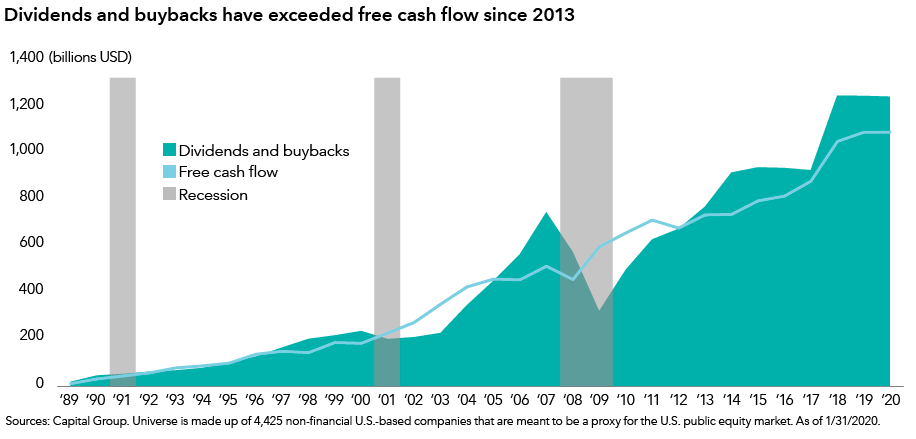

Our equity analysts collaborate with our fixed income team to evaluate the risk that a company may cut its dividend to avoid a credit rating downgrade. High levels of corporate debt could impact dividend sustainability.

Our analysts and portfolio managers are also weighing subjective issues that could impact the dividend, such as:

- Acquisitions: Companies may prioritize acquisitions, buying smaller or weaker competitors for strategic reasons while valuations are distressed, and cutting dividends to accelerate debt repayment.

- C-suite changes: A recently appointed CEO or new chairperson of the board may not have the same level of commitment to past dividend policies.

- Board composition: Some board members may be executives of other companies who have cut dividends and may not have any qualms about doing it again.

Consider upgrading your portfolio

A new paradigm is emerging for dividend-paying stocks and, therefore, we believe it is important to upgrade income-oriented portfolios. In our view, an effective approach involves:

- Diversification: Generating a disproportionate amount of income from a given sector or region can increase the risk of a severe reduction of dividend income. Companies in many sectors outside of traditional areas, such as technology and health care, now pay dividends. A global approach, where appropriate, also expands the pool of dividend-paying companies, providing further diversification.

- Fundamental research: Financial and liquidity analysis can help assess the ability of a company to pay its dividend in a variety of scenarios through collaboration with equity and fixed income analysts.

- Holistic perspective: This involves assessing myriad qualitative and subjective factors including any recent management changes, the composition of the board and the company’s approach to M&A during a time of distress.

Our latest insights

-

-

Interest Rates

-

Global Equities

-

Artificial Intelligence

-

Technology & Innovation

RELATED INSIGHTS

-

-

-

Artificial Intelligence

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian mutual funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Dale Hanks

Dale Hanks

Marc Nabi

Marc Nabi