Retirement Income

Retirement Income

This article is part of our Retirement Plan Trends series, which explores issues affecting the retirement space.

Conventional wisdom says one way to build a successful portfolio is to choose a mix of investments that generate a satisfying return while maintaining an acceptable level of risk. Yet, when it comes to retirees, we thought there might be more to it.

Partnering with Escalent, a behavior and analytics firm, we sought to understand what factors beyond portfolio results contribute to a successful, happy retirement.* To do that, we focused on peace of mind in retirement and the factors associated with it.

Measuring “peace of mind” as a single idea is hard to do because it means different things to different people. To help, we sorted retirees and near-retirees by their “investment personalities,” which helped us uncover some of the factors that provide them with the greatest peace of mind.

What gives investors peace of mind?

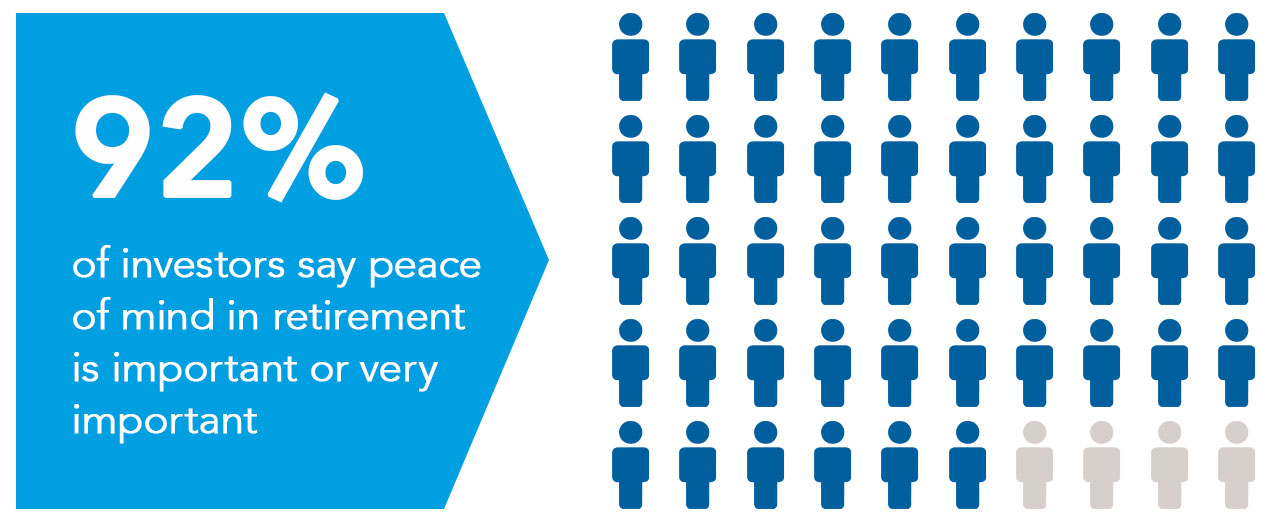

Overwhelmingly, our proprietary research found that over 9 out of 10 of retirees and near-retirees identified peace of mind as extremely important or very important to them in retirement.

Source: Escalent, Capital Group survey, April 2022. Responses to the question: “How important is peace of mind to you in regard to your retirement?”

Of those individuals who consider peace of mind to be extremely important, most tended to be those with modest levels of education, as opposed to those with four-year college degrees or advanced degrees; the mass affluent, as opposed to high net worth; and more women over men, regardless of retirement status. The study also revealed that the way in which investors go about achieving peace of mind in retirement can differ, but most seek to achieve freedom, time and spontaneity.

Can peace of mind be quantified?

Measuring peace of mind can get complicated. While it may be easier to measure things like risk and return, our research found that risk and return aren’t the only ways to gauge a successful outcome.

We found that optimism and serenity are the dominant emotions associated with peace of mind, followed by trust and joy. And from a portfolio construction perspective, having the confidence in knowing that essential needs are covered by a secure income emerged at the forefront of achieving peace of mind.

Indeed, access to secure income has important ramifications in retirement. Across all three segments of investor personalities, we found that covering ongoing monthly living expenses (91%) and never running out of consistent income (87%) are very important. In addition, 82% said maintaining their current living standard is very important to their peace of mind.

Secure income and peace of mind

The connection between peace of mind and secure income was strong across all three “investment personality” segments defined in the survey, with 87% citing it as most important.

The “self-assured” investor

This type of investor feels confident in their own financial planning skills. Their ability to have complete control over when to adjust their finances and when to maintain the status quo provides them with the greatest peace of mind. These investors are extremely confident that they have set themselves up for a successful retirement and are comfortable with fluctuations that may occur in the balance of their investment accounts.

“I know best and because of that I have everything that I need.”

What to know: According to our study, the self-assured investor seeks growth as an important part of their psychology. Their investment risk tolerance tends to be high since they feel confident with their financial standing.

The “risk-averse” investor

This type of investor likes to rely on financial professionals to help them. Their top concern is longevity risk and major fluctuations in their investment account balances. Out of the three investor types, this group rates the importance of a guaranteed income the highest at 95%, as they favor consistency and a level of protection.

“The less I have to think about my income, the less I will worry.”

What to know: The risk-averse investor would likely benefit from additional support from their financial professional to discuss available options of protected income sources.

The “validated” investor

This type of investor looks to their financial professional for reassurance in their financial goals and decisions. They tend to have lower confidence and prefer to not think about their finances on a regular basis. They view guaranteed income as important to their peace of mind, with 92% stating as such because they prefer not having to think about the source of their income.

“I’m worried and need someone to help reassure me.”

What to know: The validated investor tends to have a lower risk tolerance and places higher trust in their financial professional but remains cautious.

We found most investor types prefer to have a source of protected income and that those that already hold those types of assets — including Social Security, pensions and annuities — have achieved a greater peace of mind in retirement. They worry less about where their income is coming from and focus more on what they want to do with their freedom and time.

Engaging with clients

Understanding the various segments and acknowledging what is important to investors can help financial professionals and plan sponsors improve engagement with clients and participants while seeking to help provide them with both peace of mind and successful investment strategies.

* About the survey: Capital Group, partnering with behavior and analytics firm Escalent, conducted an investor study of 1,000 retirees and pre-retirees with investable assets of at least $250,000. The study was aimed at understanding their perceptions of financial peace of mind and its value to them. The online study was conducted in February 2022 and Capital Group was not revealed as the research sponsor. In addition to the asset level requirement, respondents had to be either retired or less than 10 years from retirement, and have one or more of the following: an ESRP, an app-based/online investment account, a full-service brokerage account, or an IRA.

Our latest insights

-

-

Target Date

-

Practice Management

-

Participant Engagement

-

Practice Management

RELATED INSIGHTS

-

Retirement Income

-

Participant Engagement

-

Practice Management

Never miss an insight

The Capital Ideas newsletter delivers weekly investment insights straight to your inbox.

Kate Beattie

Kate Beattie