Trade

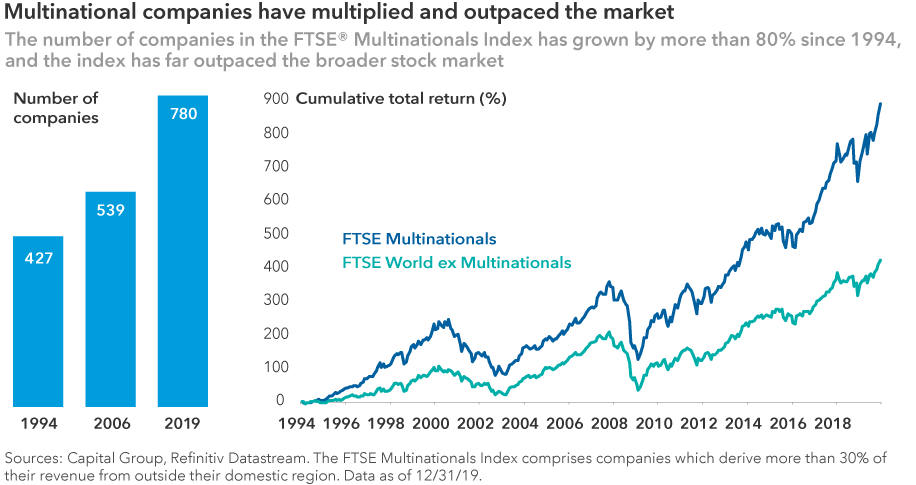

- Multinational companies are deftly adapting to a less friendly global trade environment.

- A multilocal approach to business is putting multinationals closer to consumers.

- An uneasy truce in the U.S.-China trade war is promising, but uncertainty continues to cloud the long-term outlook.

As a portfolio manager who invests in many large, multinational companies, the most common question I get these days is whether I am worried about the impact of a global trade war. At a time when tariffs and other restrictions are threatening to reverse decades of trade liberalization, are these companies the most vulnerable of all?

The answer may surprise you: While I certainly follow political events, I am not overly concerned about the impact on well-managed multinationals. Simply put, they are the best-positioned companies to navigate an uncertain environment and devise effective solutions, including a multilocal approach to business that puts them closer to consumers around the world.

A temporary trade truce

When I first discussed this subject nearly two years ago, the U.S.-China trade war was just beginning to heat up. Since then, we’ve seen several twists and turns which ultimately led to a “phase one” trade deal adopted by Beijing and Washington on January 15.

Clearly, this trade pact is a step in the right direction: China has agreed to buy more U.S. products while the U.S. reduces some tariffs on Chinese-made goods. However, we still have a long way to go before the world’s two largest economies address more thorny issues, such as intellectual property theft and heavy subsidies for Chinese state-owned enterprises. Those may take years, or even decades, to resolve.

In the meantime, companies that conduct business all over the world are doing what they do best: navigating treacherous waters and finding ways to succeed regardless of the geopolitical headwinds.

Turn down the noise

What’s the rationale for my high level of confidence? There is a reason why multinational companies have come to dominate the global economy and financial markets. For the most part, they are run by smart, tough, experienced managers. This isn’t their first rodeo. They have seen all types of trade environments, favourable and unfavourable. Therefore, in my view, these battle-tested companies are in the best position to survive and even thrive in a hostile landscape.

For investors, it’s important to avoid focusing too much on the noise surrounding trade and protectionism. It’s easy to get lost in the rhetoric over steel or soybeans or whichever commodity is targeted next. There are conflicting data points every day and many of them are inconsequential. To the extent that trade conflicts cause investors to shy away from multinational companies, paying too much attention to the rhetoric is a detriment to successful, long-term investing.

Rearranging the chess board

If I’ve learned anything during my 31 years as a professional investor, it’s that smart companies will figure it out. Invest in strong, global companies with seasoned management teams and — more often than not — they will rise above the fray. The best-run companies in the world will find ways to win even when governments are trying to rearrange pieces on the chess board.

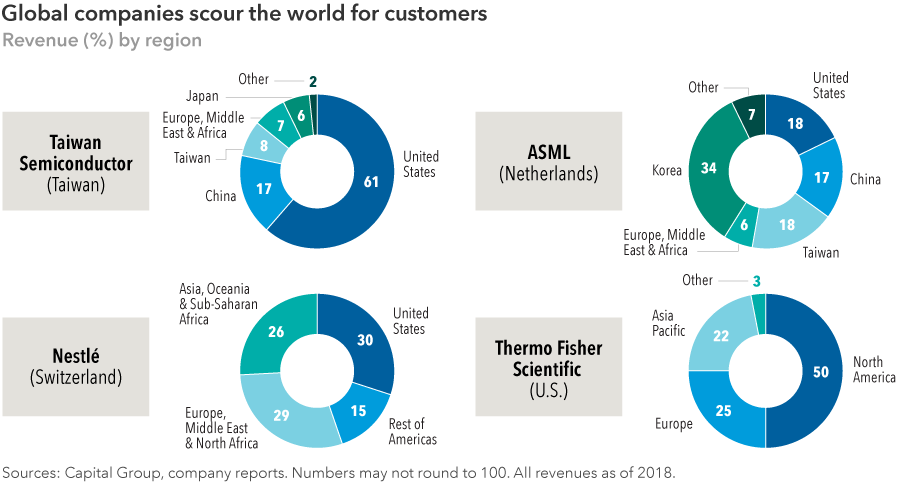

For example, the multilocal business approach I referenced earlier is gaining traction. Many global companies are establishing successful operations in local markets, rather than retreating in the face of trade barriers. More and more, it is becoming crucial for multinationals to produce where they sell. In order to succeed, they must be able to move swiftly and respond effectively to local competition.

Just do it, locally

Sports apparel giant Nike optimizes this approach with its hyper-local sales initiatives. For instance, Nike has launched a data-driven retail store in Los Angeles that stocks shoes according to online buying trends in surrounding ZIP codes. It doesn’t get much more local than that. In Europe, Nike has established a speedy supply-chain initiative that allows it to tailor colours and new materials based on individual customer preferences in each city where it operates.

Visa and Mastercard are following much the same approach when it comes to electronic payment processing — which must be tailored not just to the preferences of local customers but also to the strict financial regulations of many different governments around the world. As a result, both are growing at a healthy pace while evolving and adapting to a changing set of competitors in the fintech industry.

Meanwhile, a company you may have never heard of, Switzerland-based Temenos, is rapidly growing its highly local business of providing enterprise software programs for banks. Many of its customers are using old technology, and they require ultra-local solutions to comply with state and federal banking regulations. This low-profile company has grown fast in Europe and is now in the midst of an ambitious expansion into the United States.

Emerging competition

In many ways, this multilocal approach is crucial for companies based in the U.S., Europe and Japan that are looking to stay relevant or expand into faster growing emerging markets. Many of those countries — China, India, Brazil, etc. — are nurturing their own multinational giants, as well as smaller single-country-focused competitors, and they are not waiting for the traditional global players to catch up.

Aside from all the trade worries, some large multinationals are being leapfrogged by smaller competitors who are more in touch with local markets. In my view, that is a bigger threat than any political issue. Emerging market consumers are looking for brands that they can trust and companies that know the local marketplace. So large multinationals that can break themselves down, think locally, act nimbly and launch products more quickly should be better positioned for success in the long run.

Ultimately, I believe cooler heads will prevail and the trade disputes eventually will be resolved. But the challenge posed by fierce local competition will continue to be a very effective motivator in the global economy, as it always has been.

Our latest insights

-

-

Global Equities

-

Artificial Intelligence

-

Technology & Innovation

-

RELATED INSIGHTS

-

-

-

Technology & Innovation

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian mutual funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. We assume no liability for any inaccurate, delayed or incomplete information, nor for any actions taken in reliance thereon. The information contained herein has been supplied without verification by us and may be subject to change. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2024. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Jody Jonsson

Jody Jonsson